Search

Common Retirement Plans For Small Business Owners

Your business owner clients have many options when establishing retirement plans. Several key factors, specific to each client’s unique...

Dec 28, 2022

The 3 Big CPA Problems

The 3 Big CPA Problems (we can help with). Having to explain the negative tax consequences of decisions their clients made last year.

Dec 15, 2022

What Issues Should I Consider When Starting A Business?

What Issues Should I Consider When Starting A Business? First-time entrepreneurs and seasoned business owners alike can benefit

Sep 6, 2022

What issues should I consider with my employer benefits?

What issues should I consider with my employer benefits? Electing benefits can be a daunting task, and it’s difficult to know which benefit

Jun 8, 2022

As A Retiree, What Issues Should I Consider When Reviewing My Tax Return?

Reviewing a client’s tax return can always be an informative exercise to ensure we understand all sources of income and tax liabilities

Mar 23, 2022

Will The Deductibility Of My Retirement Plan Contributions Be Impacted By The QBI Rules?

The QBI (Qualified Business Income) deduction rules are complicated. One of the newest planning issues to consider deals with a possible QBI

Mar 14, 2022

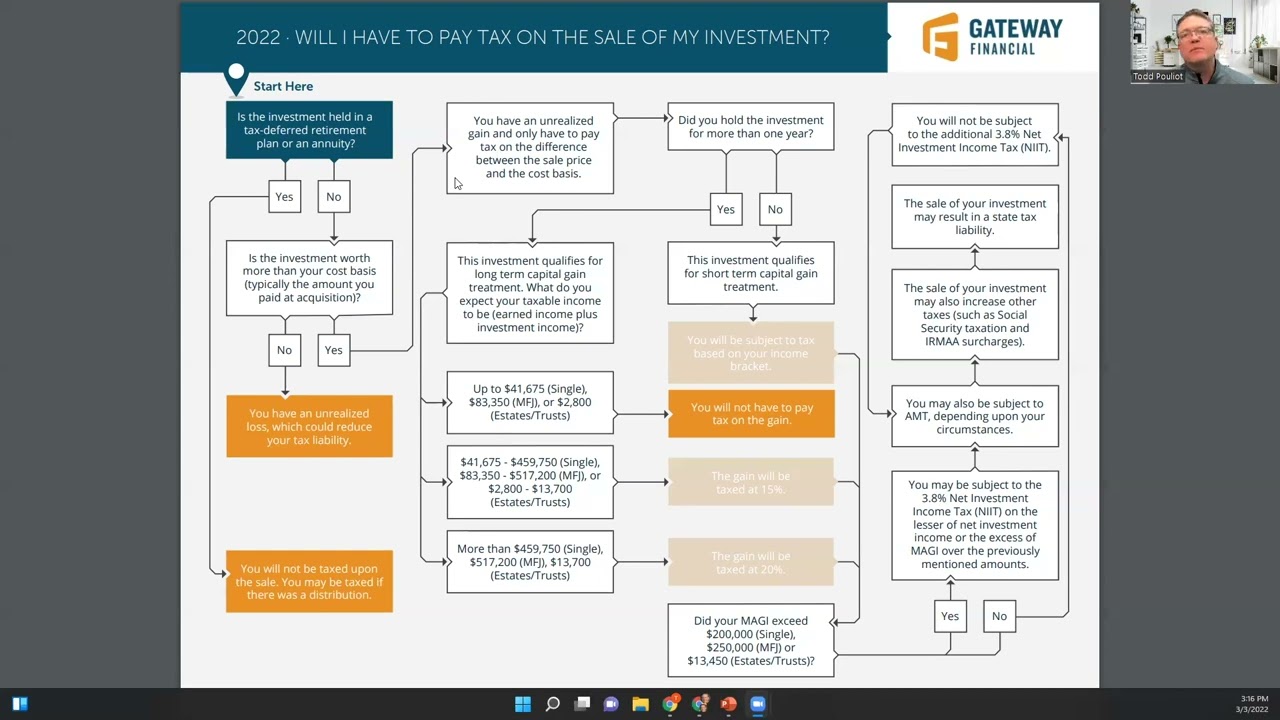

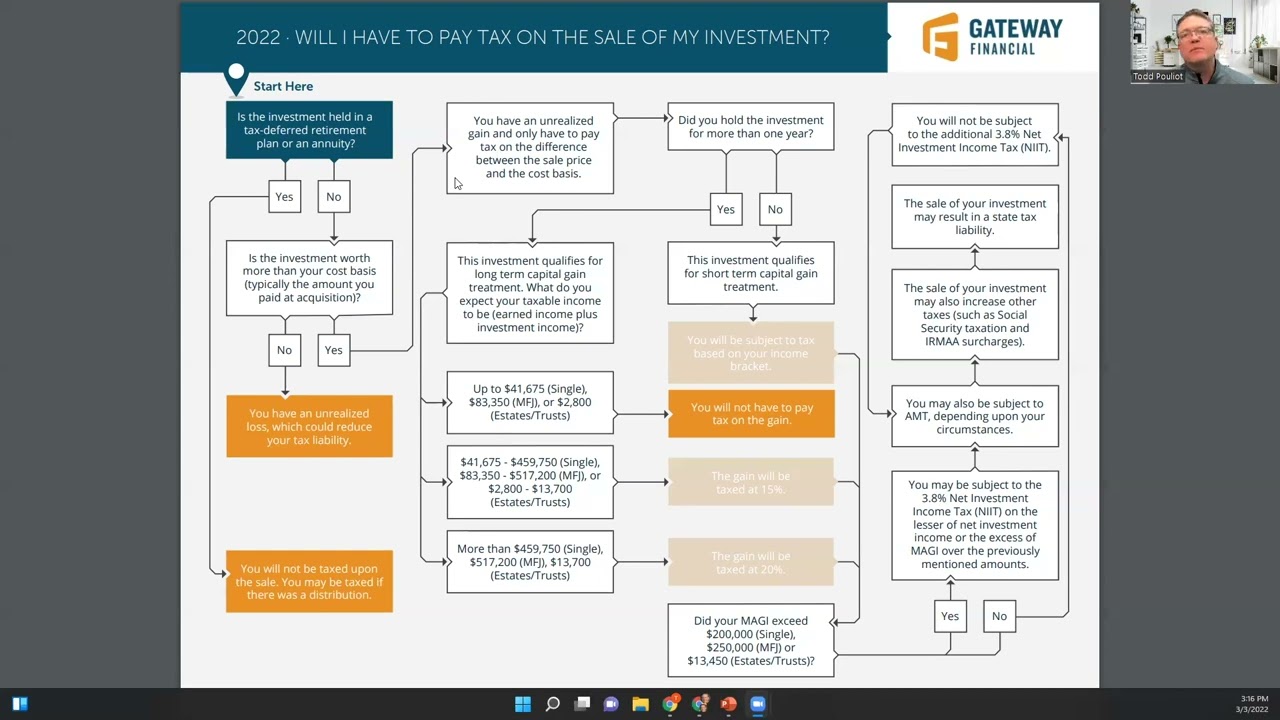

Will I have to pay tax on the sale of my investment?

Determining the tax impact of selling an investment can sometimes be complicated. There are several questions...

Mar 8, 2022

What is Tax Planning?

WHAT IS TAX PLANNING?

Tax planning refers to our review of your tax return to identify potential planning opportunities.

Feb 2, 2022

What issues should I consider if I get a promotion or raise at work?

When a client receives a promotion or a raise at work, this event can come with a number of changes that might impact their financial...

Jan 28, 2022

.png)