Search

Common Retirement Plans For Small Business Owners

Your business owner clients have many options when establishing retirement plans. Several key factors, specific to each client’s unique...

Dec 28, 2022

The 3 Big CPA Problems

The 3 Big CPA Problems (we can help with). Having to explain the negative tax consequences of decisions their clients made last year.

Dec 15, 2022

What Issues Should I Consider Before I Retire?

This checklist covers 32 of the most important planning issues to identify and consider for a client who is about to retire.

Aug 8, 2022

Should I Inherit My Deceased Spouse’s Traditional IRA?

There are a few options a client can consider when they inherit an IRA from their spouse. The best option for our clients will depend upon a

Jul 15, 2022

Should I Contribute To My Roth IRA Vs My Traditional IRA?

When saving for retirement, clients will often ask which account they should be making contributions to – a traditional IRA or a Roth IRA?

Jul 13, 2022

"Should I contribute to my Roth 401(k)?"

Should I contribute to my Roth 401(k)? Many clients may have the opportunity to contribute to a designated Roth account in their 401(k) but

Jun 22, 2022

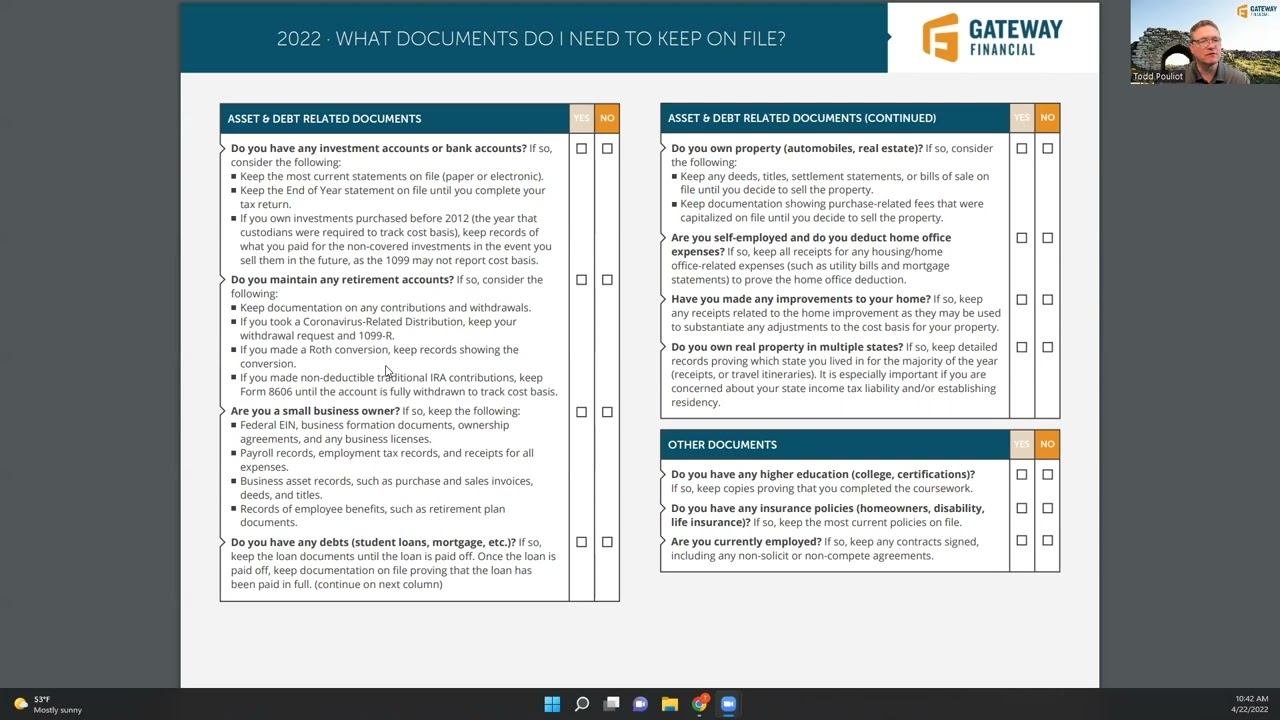

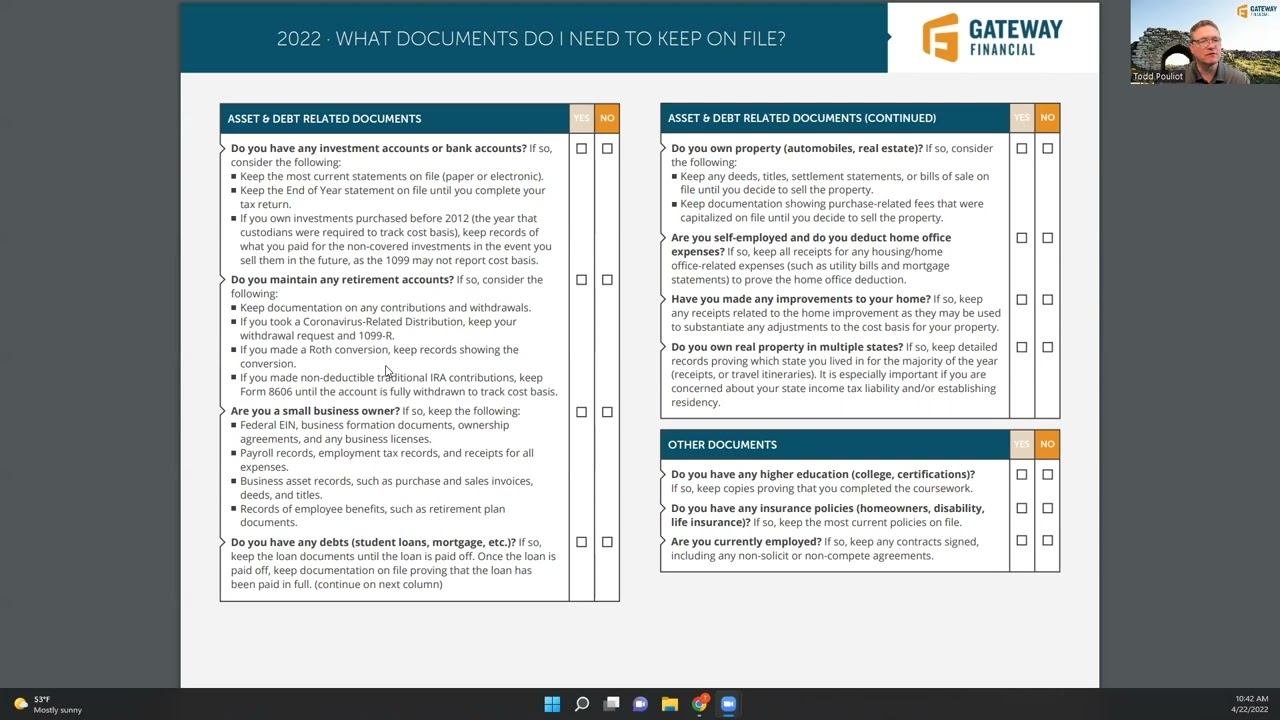

What documents do I need to keep on file?

What documents do I need to keep on file? Clients are often confused as to what documents to keep in their files. Records relating to tax

Apr 29, 2022

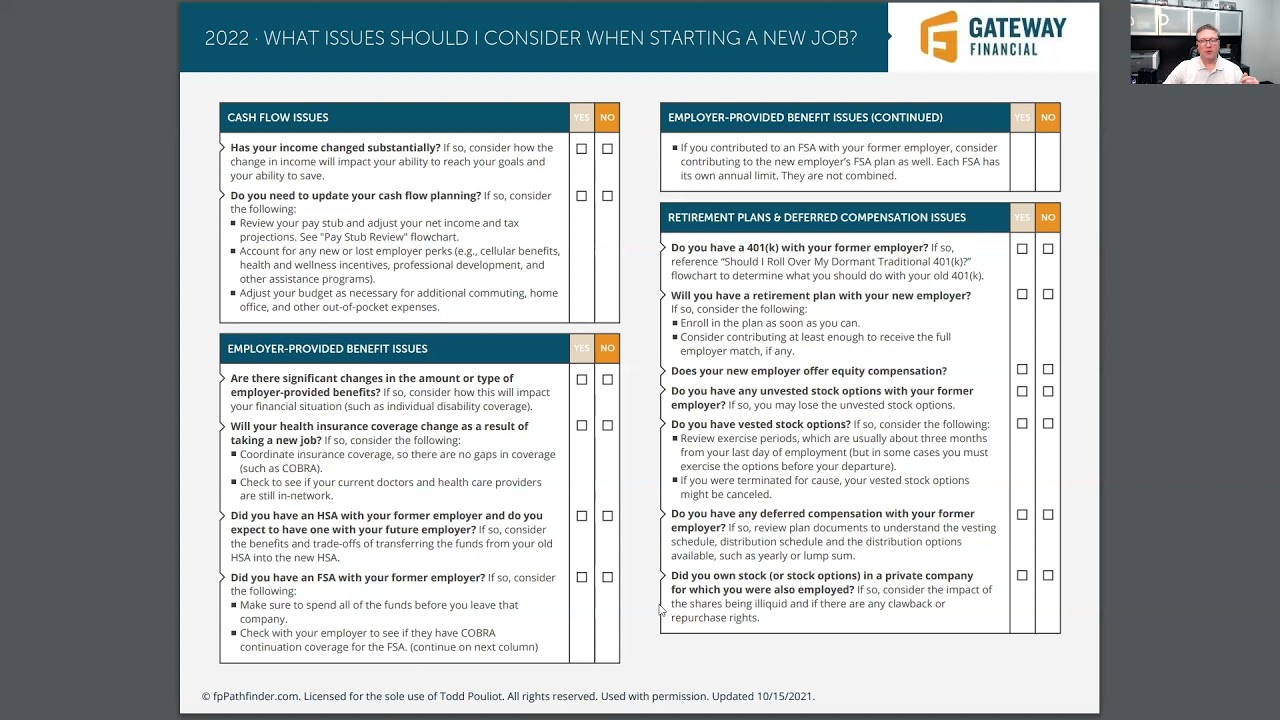

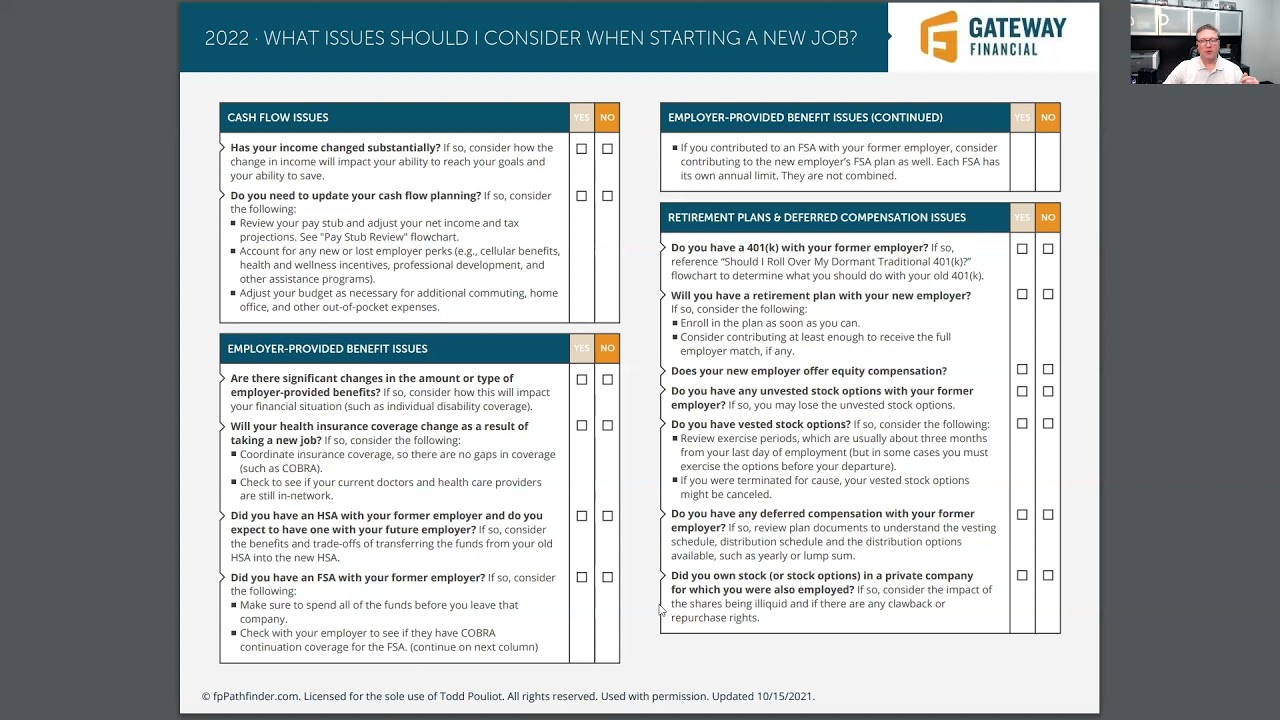

What issues should I consider when starting a new job?

When a client starts a new job, this shift can come with a number of changes that might impact their financial situation, both in positive a

Mar 25, 2022

As A Retiree, What Issues Should I Consider When Reviewing My Tax Return?

Reviewing a client’s tax return can always be an informative exercise to ensure we understand all sources of income and tax liabilities

Mar 23, 2022

.png)