Search

Will I Have To Pay Tax On My Qualified Employee Stock Purchase Plan ESPP?

Employee Stock Purchase Plans can be an important benefit for clients. These programs can allow the purchase of employer stock at a discount

Mar 15, 2022

Will The Deductibility Of My Retirement Plan Contributions Be Impacted By The QBI Rules?

The QBI (Qualified Business Income) deduction rules are complicated. One of the newest planning issues to consider deals with a possible QBI

Mar 14, 2022

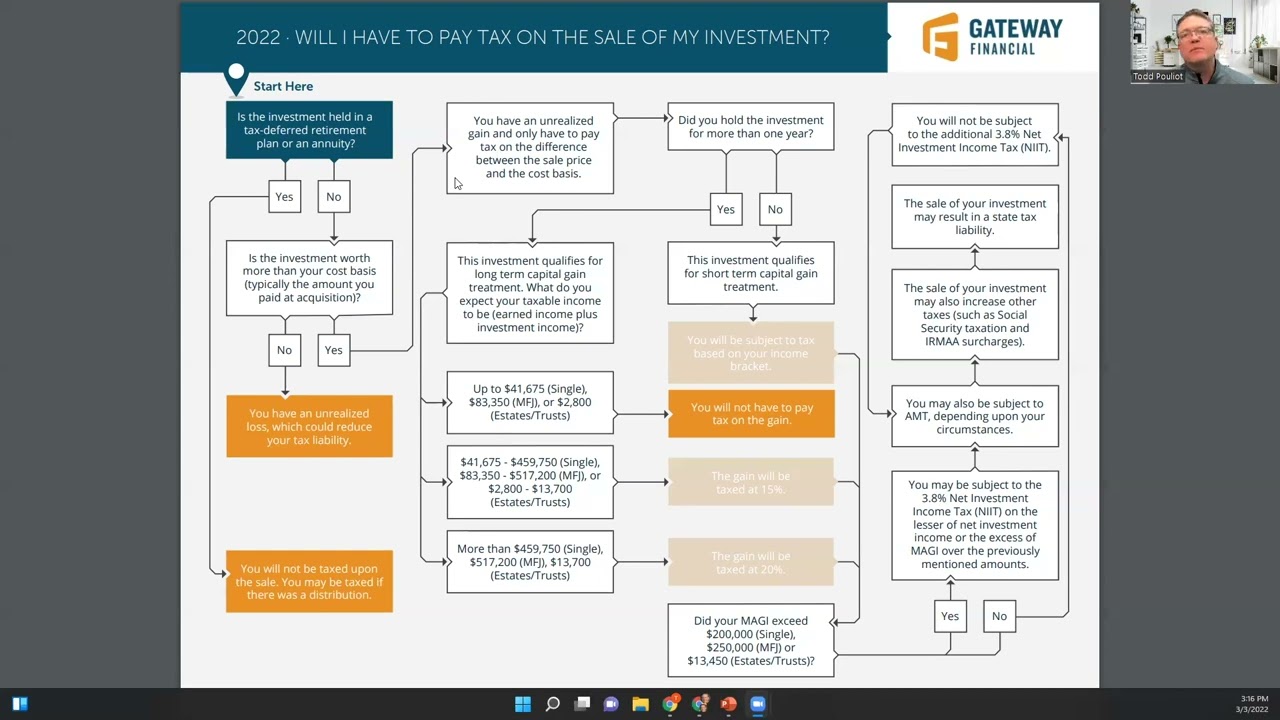

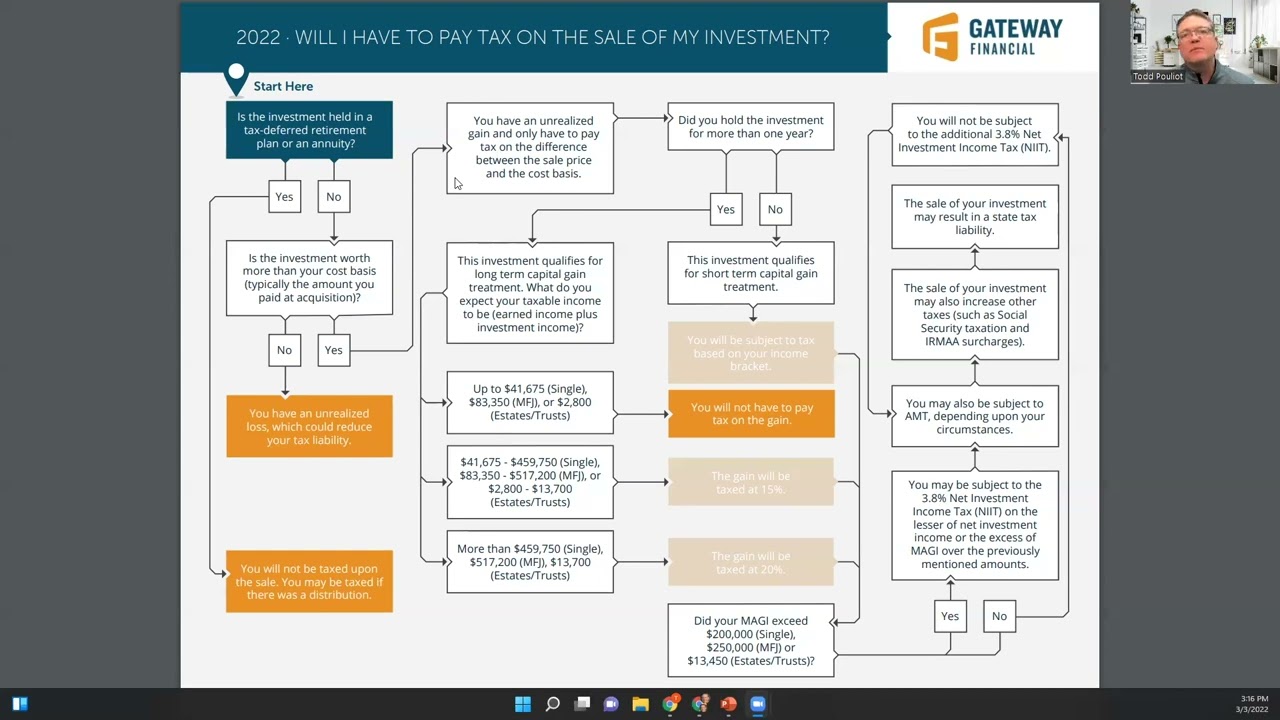

Will I have to pay tax on the sale of my investment?

Determining the tax impact of selling an investment can sometimes be complicated. There are several questions...

Mar 8, 2022

What Issues Should I Consider When Reviewing My Property And Casualty Insurance Policies?

A client’s property and casualty insurance policies are a key part of their overall financial plan. It’s important to review these policies

Mar 4, 2022

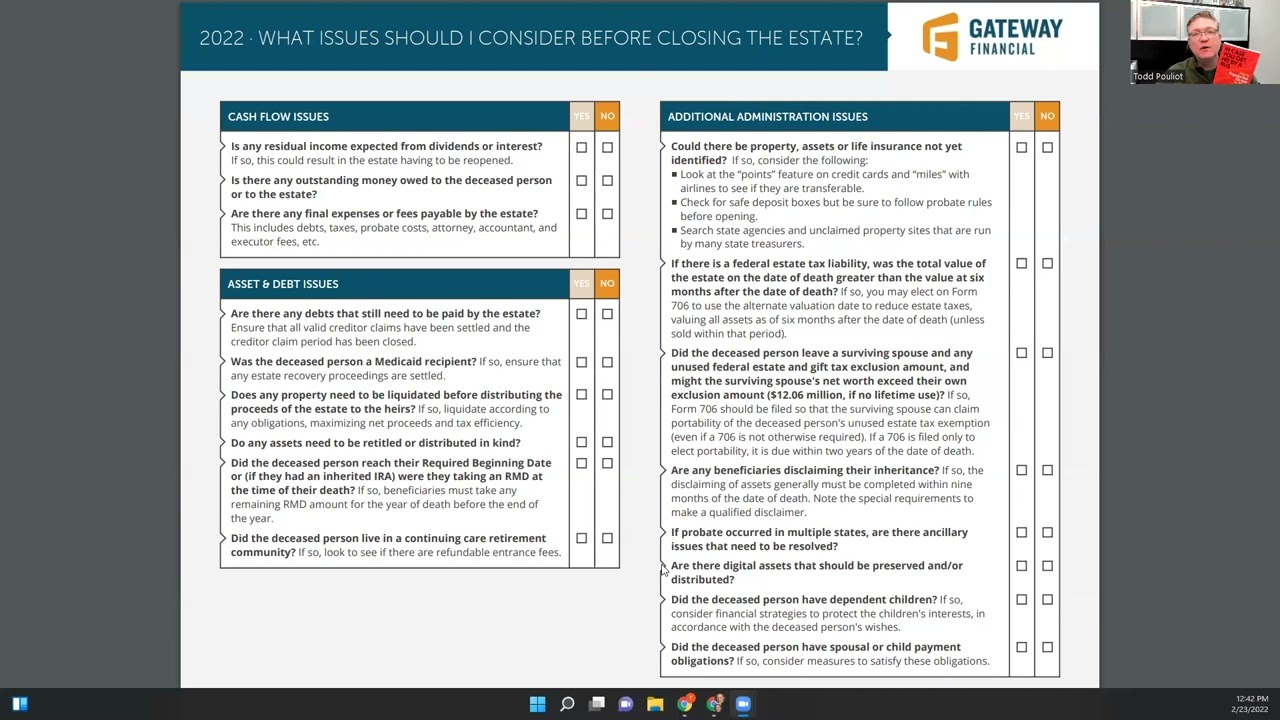

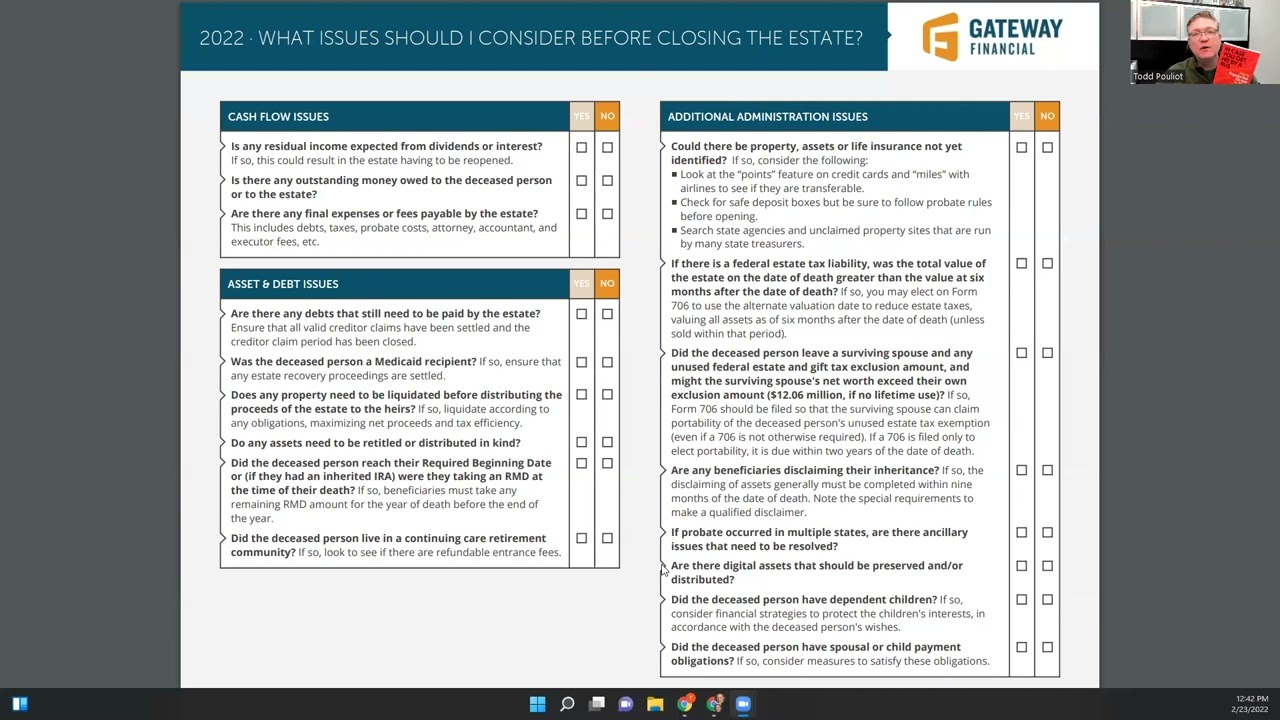

What Issues Should I Consider Before Closing The Estate?

This checklist covers 25 of the most important planning issues to identify and consider before a client closes an estate for a loved one.

Feb 25, 2022

Will Healthcare Change As I Transition Into Retirement?

To help make this analysis easier, we have created the “Will Healthcare Change As I Transition Into Retirement?” flowchart.

Feb 17, 2022

What Will Have The Least Tax Impact Harvesting Capital Gains Or Roth Conversions?

Clients often have outsized positions due to appreciation and large pre-tax retirement accounts. They may be looking to reduce risk...

Feb 15, 2022

Pay Stub Review

A pay stub is a valuable source of information when building financial models and evaluating cash flow.

Feb 14, 2022

What issues should I consider when reviewing my tax return?

Reviewing a tax return can always be an informative exercise to ensure you understand all sources of income and tax liabilities

Feb 10, 2022

.png)