Search

Should I Roll Over My Dormant Traditional 401k

Common IRA and 401(k) features and differences Net Unrealized Appreciation options Age-based distribution options Taxes and penalties in...

Feb 22, 2022

What Will Have The Least Tax Impact Harvesting Capital Gains Or Roth Conversions?

Clients often have outsized positions due to appreciation and large pre-tax retirement accounts. They may be looking to reduce risk...

Feb 15, 2022

Pay Stub Review

A pay stub is a valuable source of information when building financial models and evaluating cash flow.

Feb 14, 2022

What issues should I consider when reviewing my tax return?

Reviewing a tax return can always be an informative exercise to ensure you understand all sources of income and tax liabilities

Feb 10, 2022

What is Tax Planning?

WHAT IS TAX PLANNING?

Tax planning refers to our review of your tax return to identify potential planning opportunities.

Feb 2, 2022

What issues should I consider if I get a promotion or raise at work?

When a client receives a promotion or a raise at work, this event can come with a number of changes that might impact their financial...

Jan 28, 2022

Employee Stock Purchase Plans (ESPP)

Employee Stock Purchase Plans can be an important benefit for our clients. These programs can allow the purchase of employer stock.

Jan 27, 2022

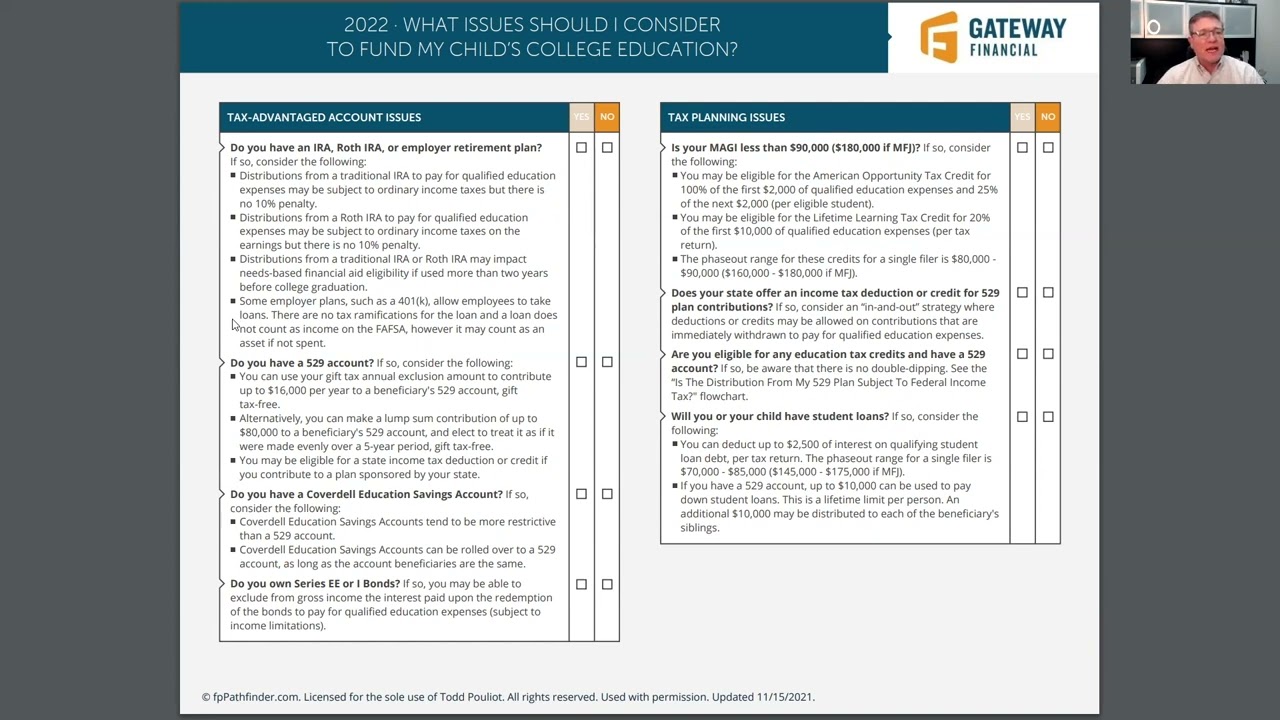

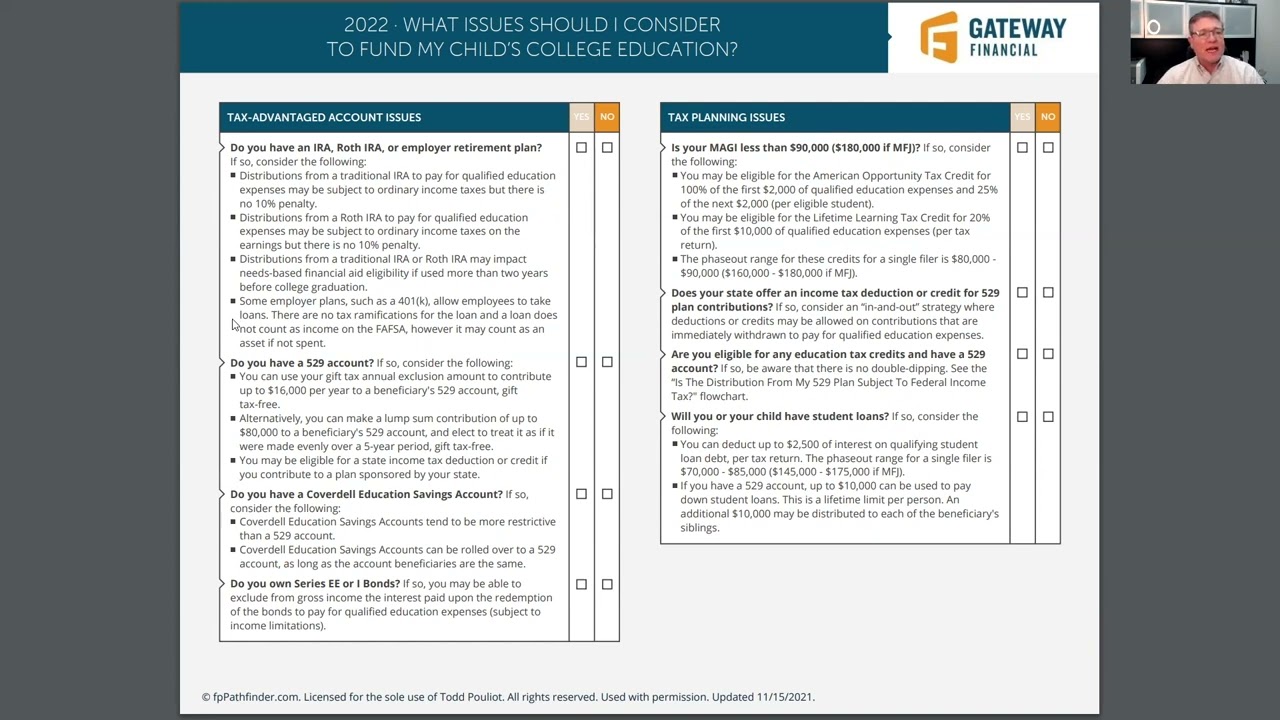

What issues should I consider to fund my child's college education?

This checklist covers 20 of the most important planning issues to identify and consider when a client is trying to determine how to fund

Jan 25, 2022

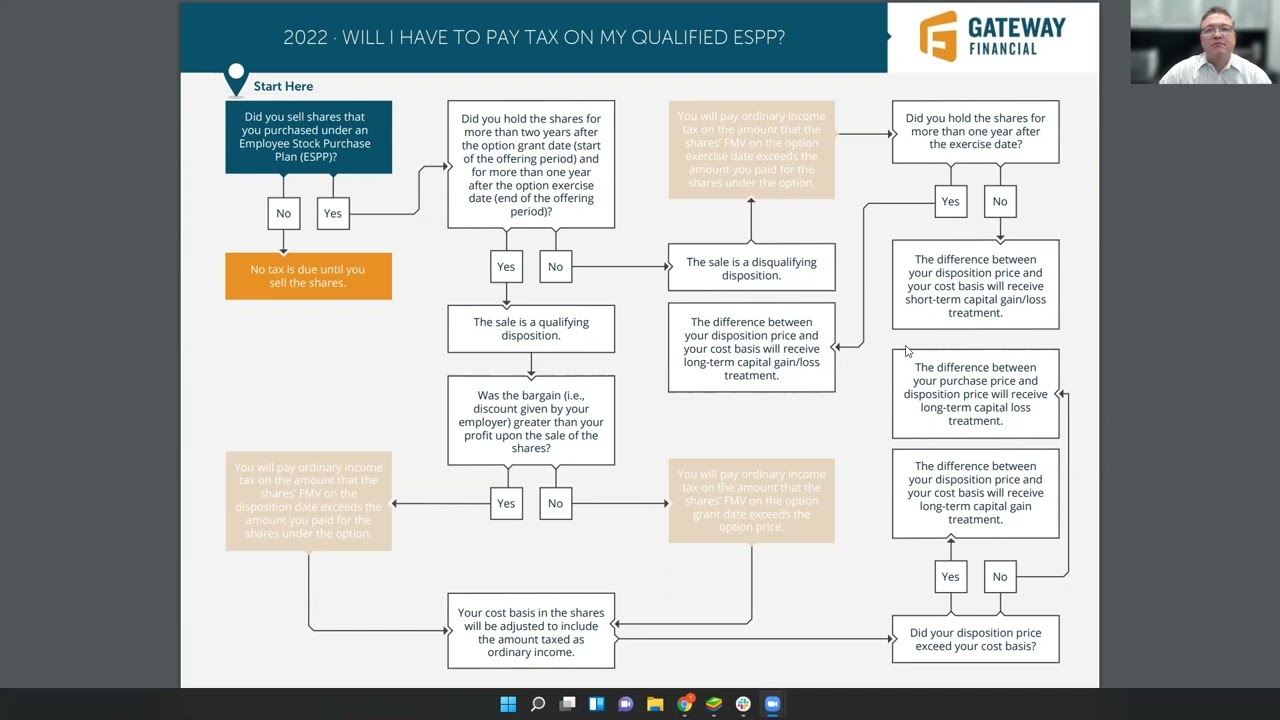

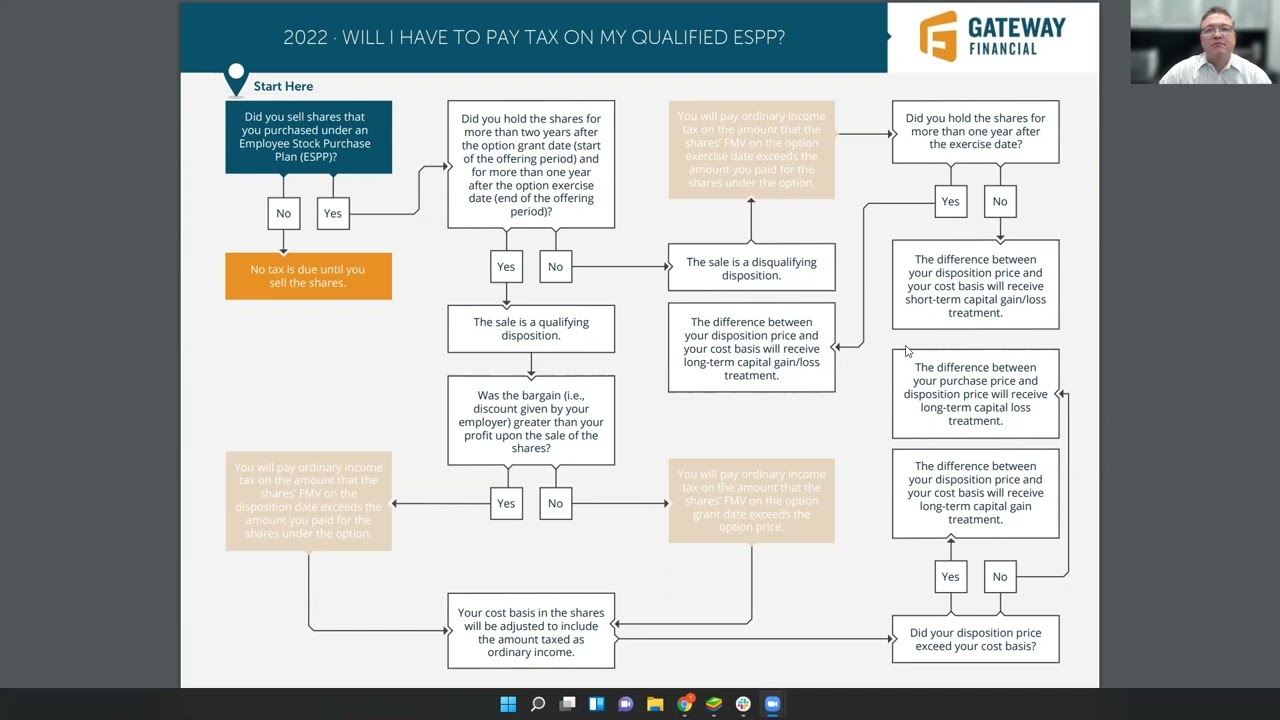

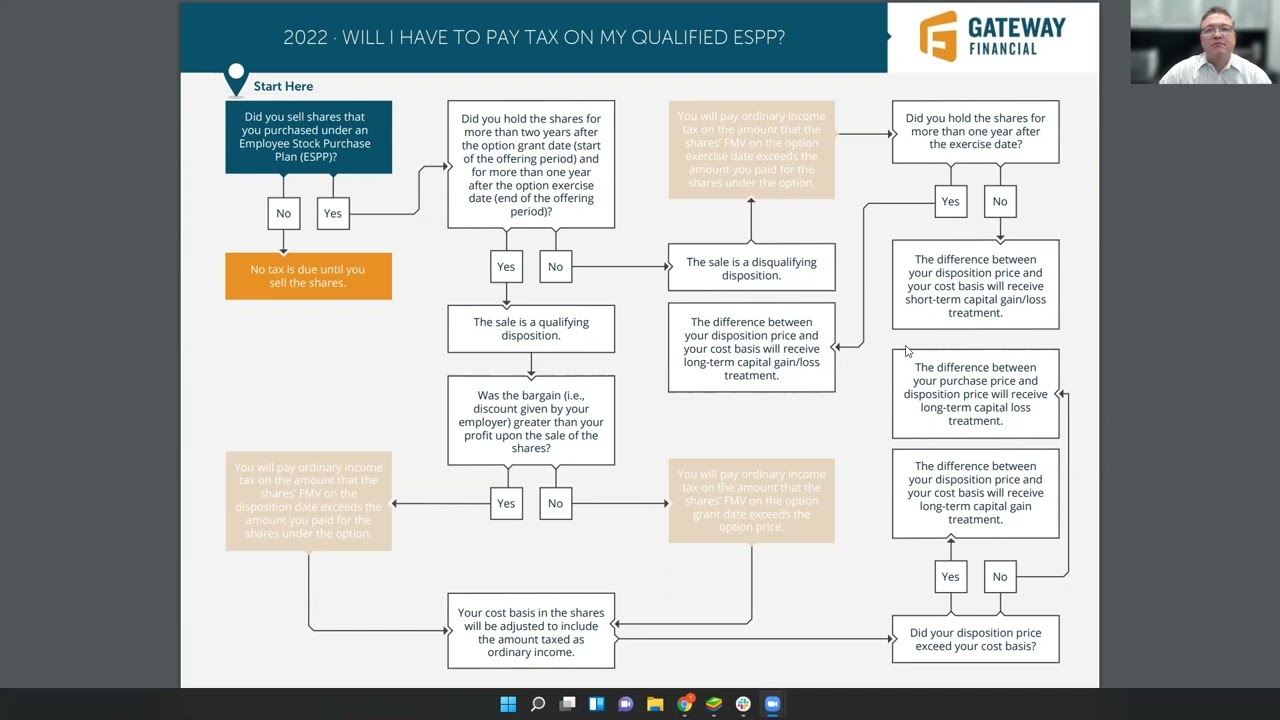

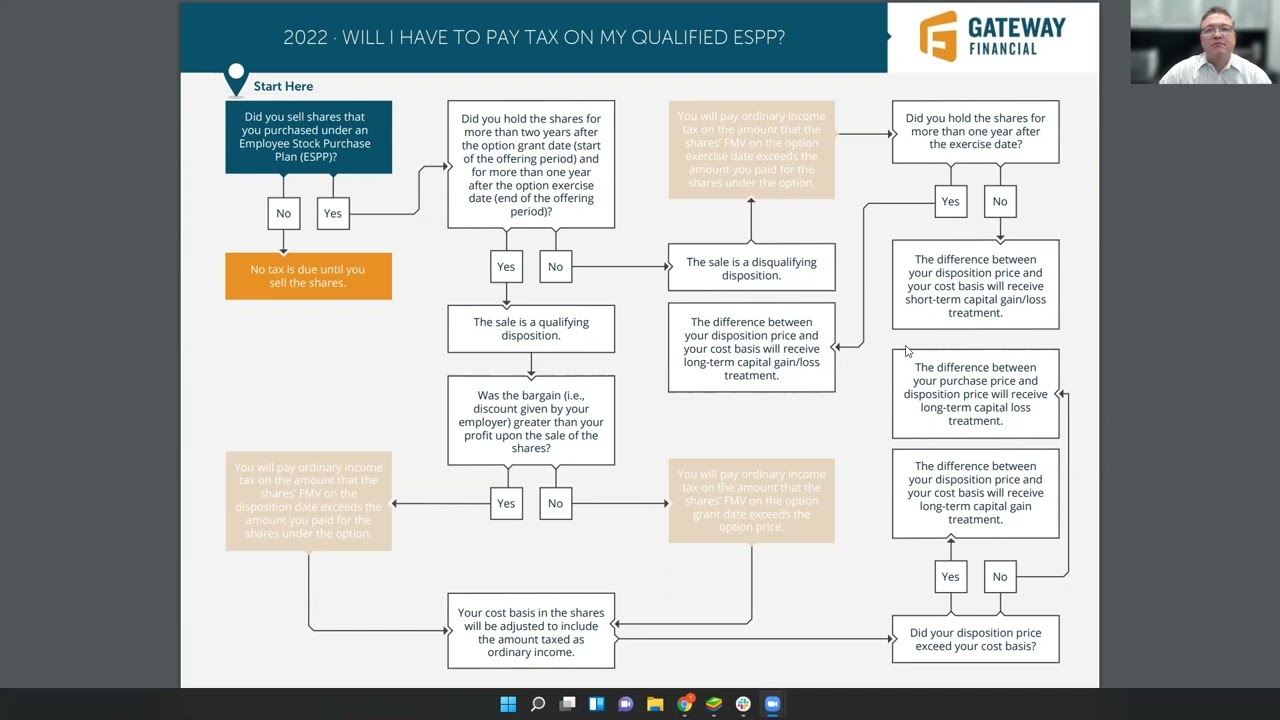

Will I have to pay tax on my Qualified Employee Stock Purchase Plan (ESPP)?

Employee Stock Purchase Plans can be an important benefit for our clients. These programs can allow the purchase of employer stock at a disc

Jan 19, 2022

.png)