Search

Apr 18, 2022

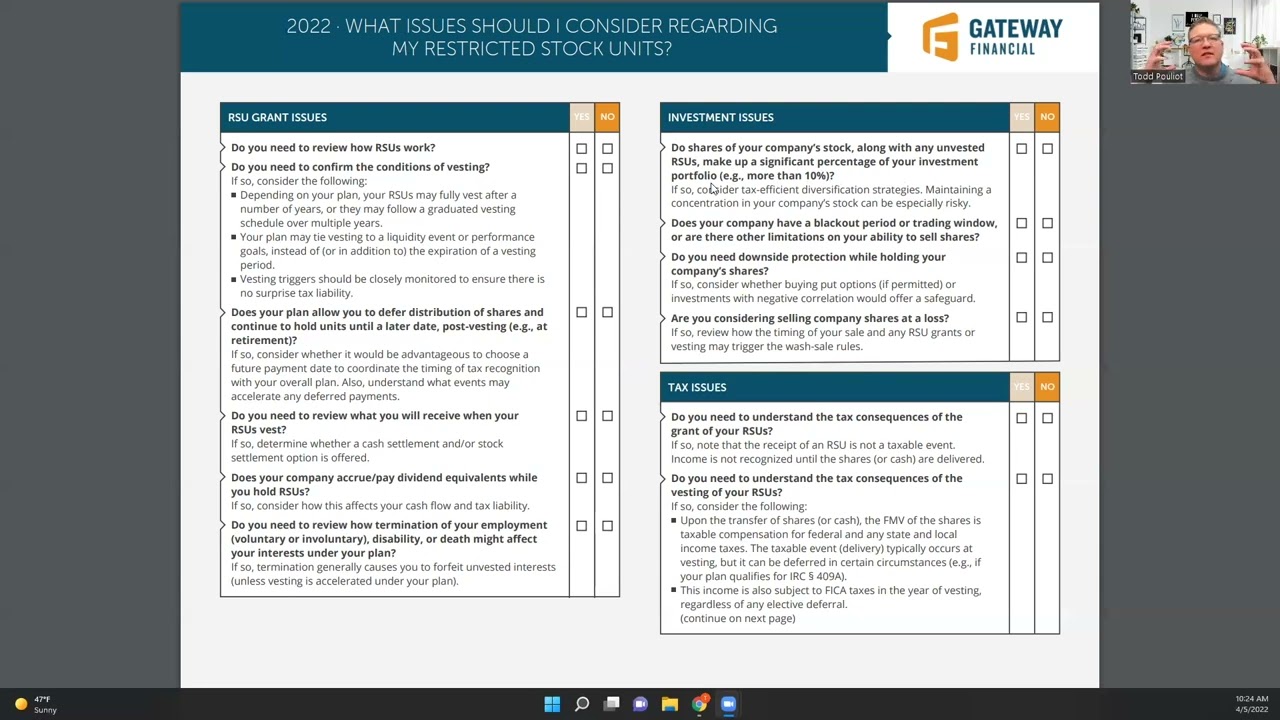

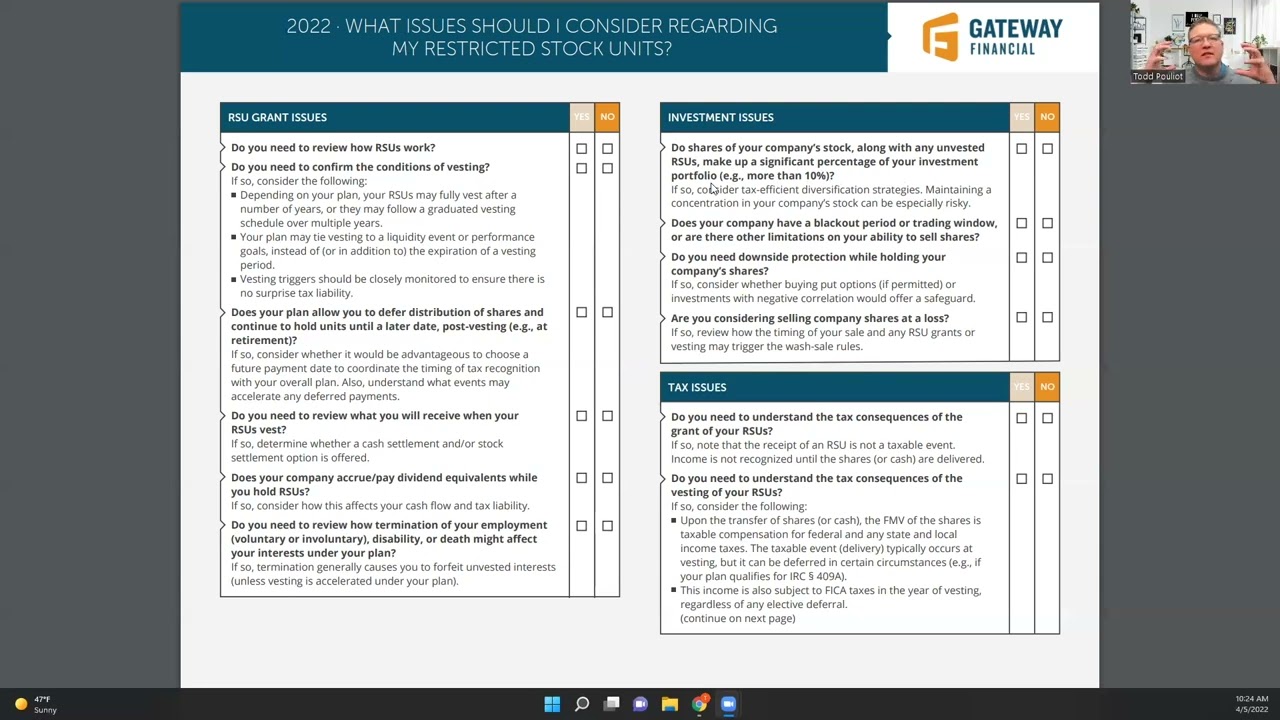

What Issues Should I Consider Regarding My Restricted Stock Units?

Restricted Stock Units (RSUs) are a popular form of equity compensation that, after vesting, result in an employee’s receipt of shares of co

Mar 31, 2022

What issues should I consider regarding my Incentive Stock Options?

Incentive Stock Options (ISOs) are a form of equity compensation, offering employees a share in the potential appreciation of a company

Mar 29, 2022

When should I claim Social Security?

Social Security should NOT be a conversation in its own silo. There are many factors that need to be considered.

Mar 25, 2022

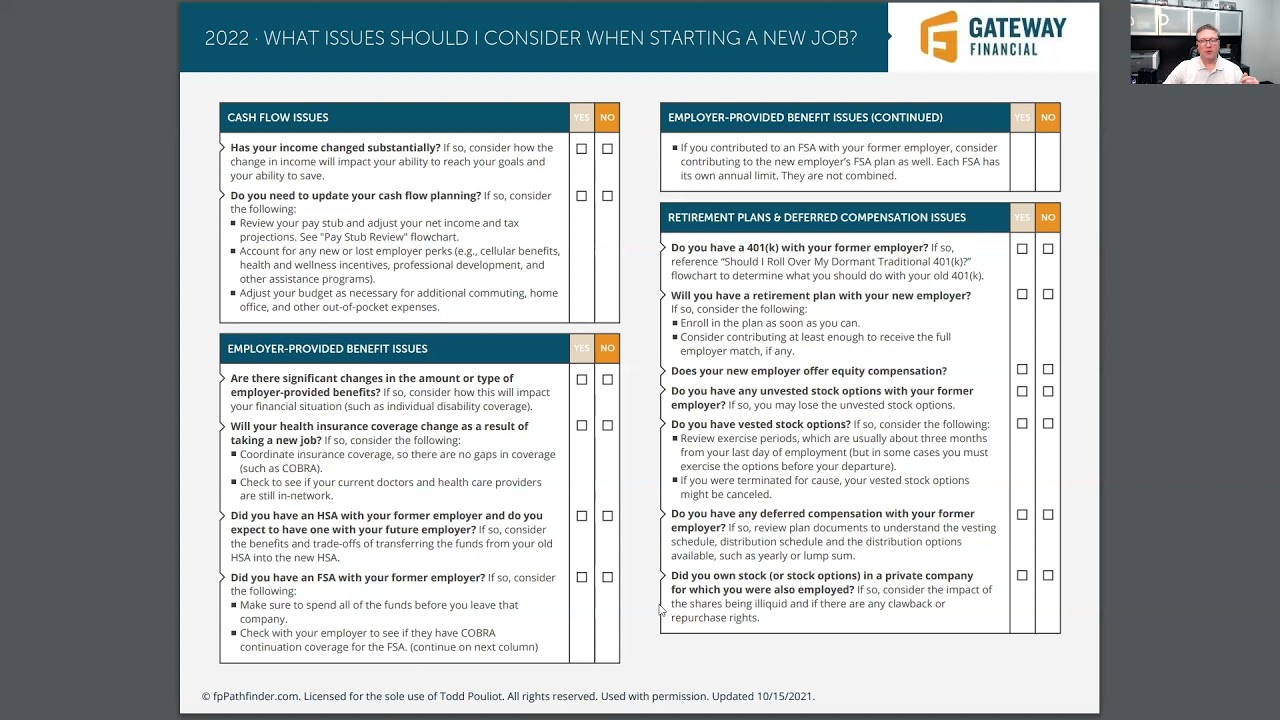

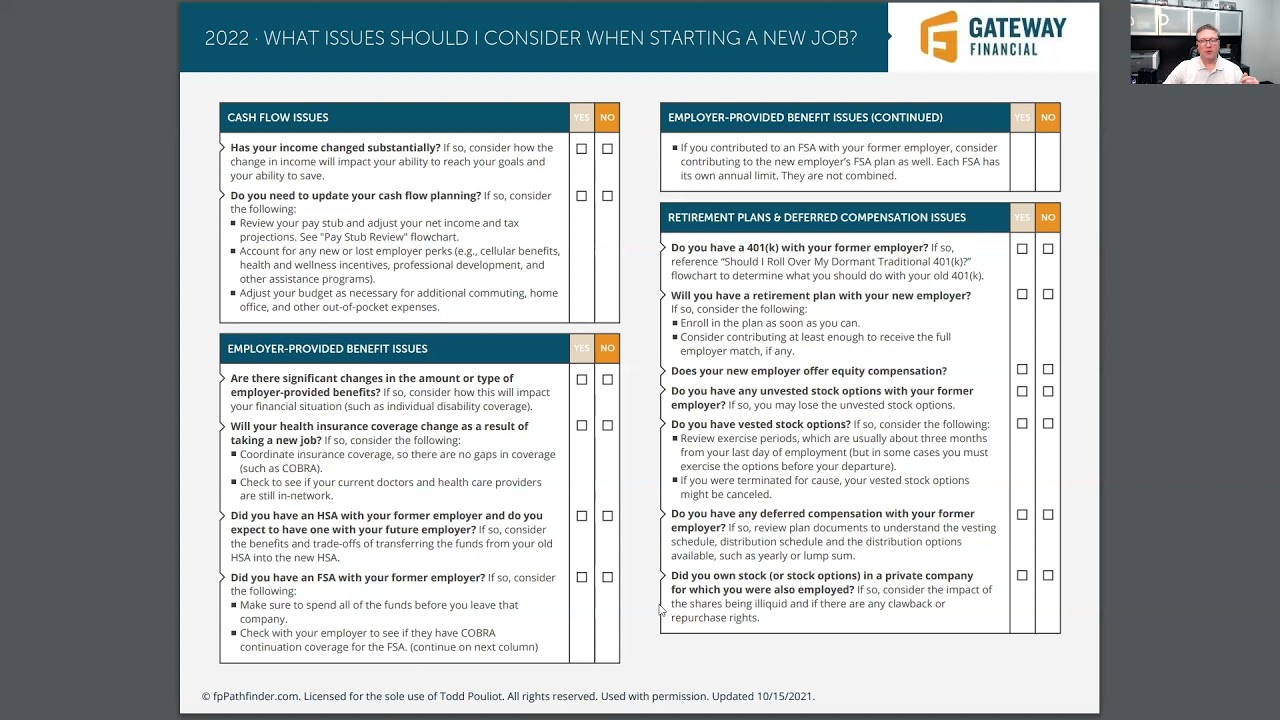

What issues should I consider when starting a new job?

When a client starts a new job, this shift can come with a number of changes that might impact their financial situation, both in positive a

Mar 24, 2022

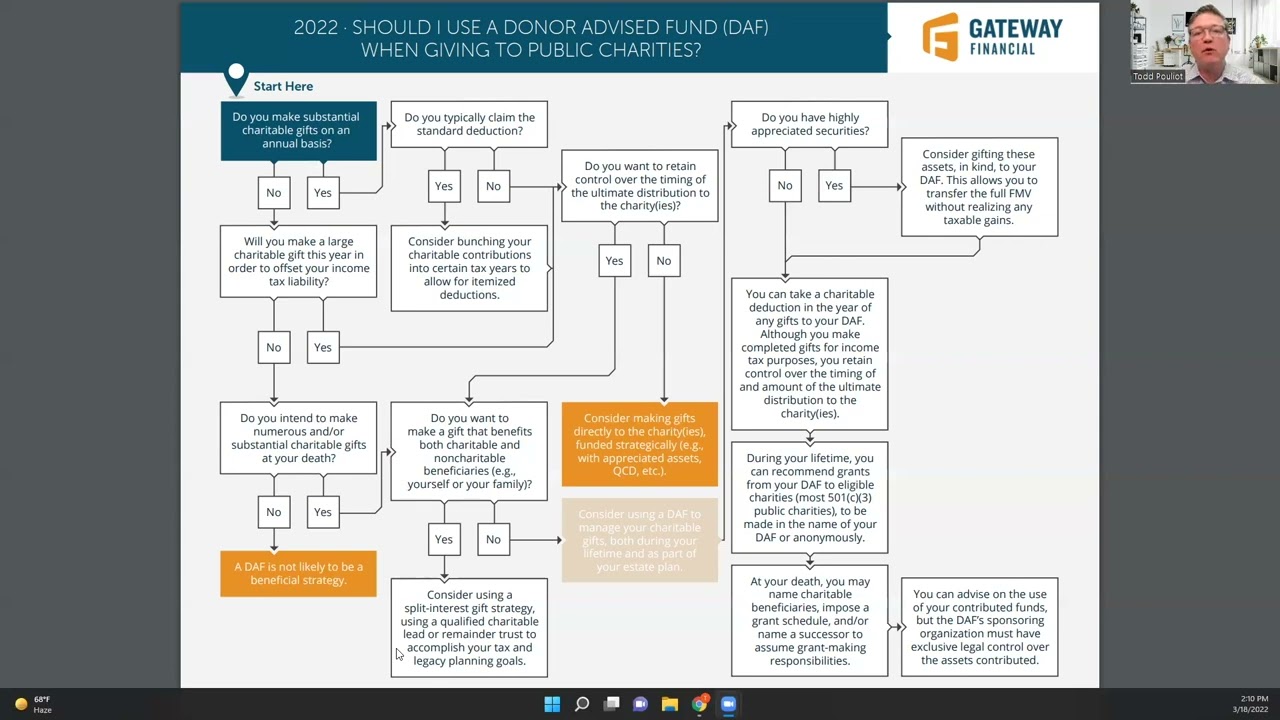

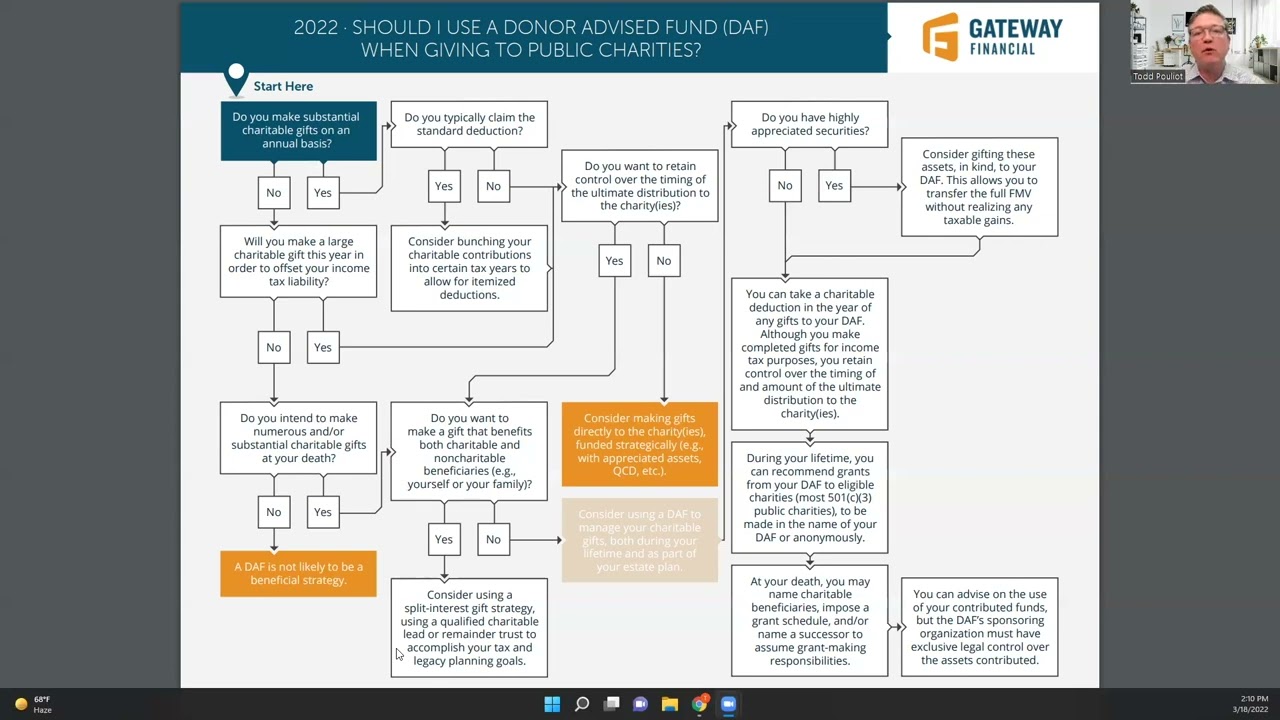

Should I Use A Donor Advised Fund DAF When Giving To Public Charities?

In the charitable giving realm, Donor Advised Funds (“DAFs”) have become increasingly popular and valuable planning vehicles.

Mar 23, 2022

As A Retiree, What Issues Should I Consider When Reviewing My Tax Return?

Reviewing a client’s tax return can always be an informative exercise to ensure we understand all sources of income and tax liabilities

Mar 15, 2022

Will I Have To Pay Tax On My Qualified Employee Stock Purchase Plan ESPP?

Employee Stock Purchase Plans can be an important benefit for clients. These programs can allow the purchase of employer stock at a discount

Mar 14, 2022

Will The Deductibility Of My Retirement Plan Contributions Be Impacted By The QBI Rules?

The QBI (Qualified Business Income) deduction rules are complicated. One of the newest planning issues to consider deals with a possible QBI

Mar 10, 2022

Will My Roth IRA Conversion Be Penalty Free?

Converting a portion of an IRA to a Roth IRA is a complex process that involves many moving parts.

.png)