Search

Federal Employees Retirement System (FERS) Supplement or Special Retirement Supplement (SRS)

Federal Employees Retirement System (FERS) Supplement, also known as the Special Retirement Supplement (SRS), is a payment made to eligible

Mar 2, 2023

The 3 Big CPA Problems

The 3 Big CPA Problems (we can help with). Having to explain the negative tax consequences of decisions their clients made last year.

Dec 15, 2022

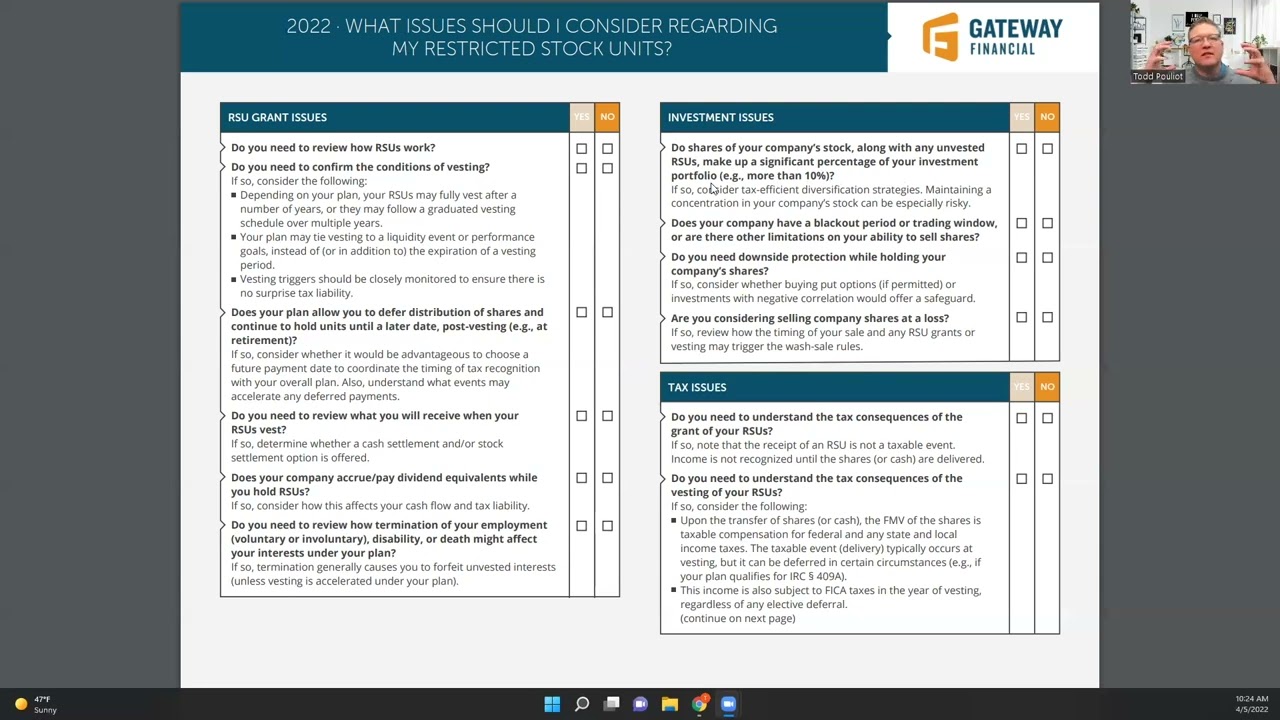

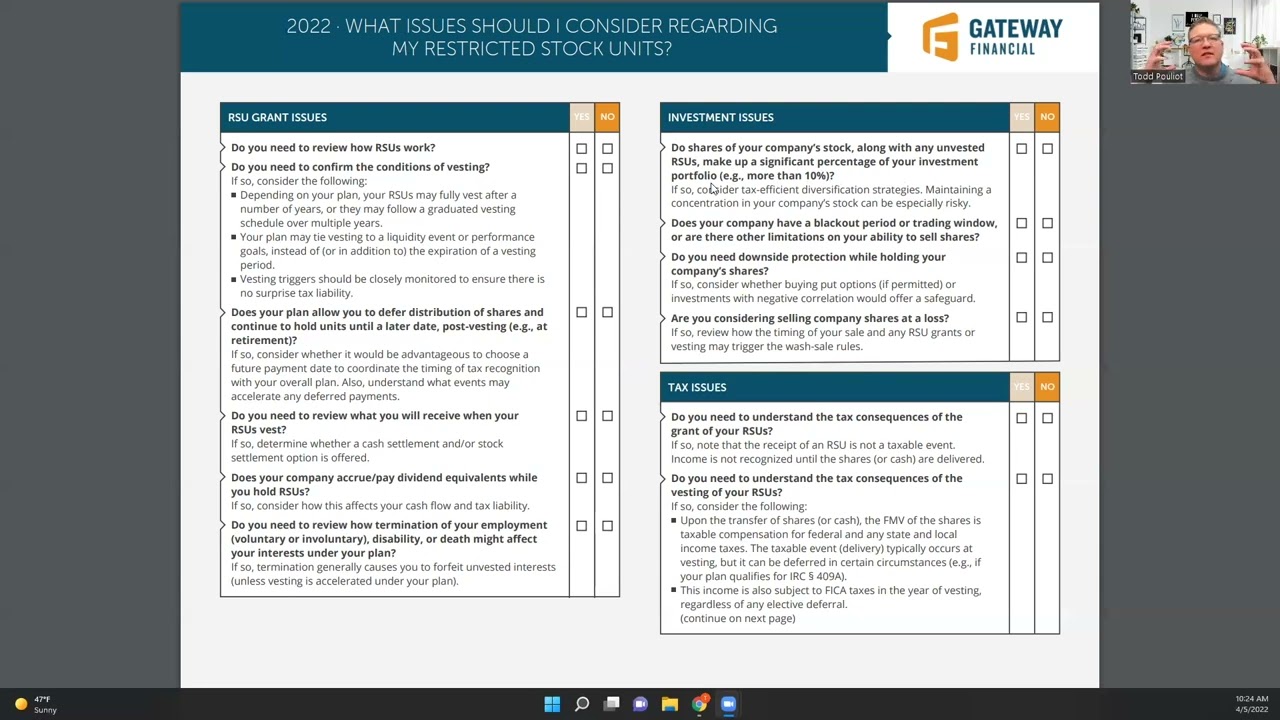

What Issues Should I Consider Regarding My Restricted Stock Units?

Restricted Stock Units (RSUs) are a popular form of equity compensation that, after vesting, result in an employee’s receipt of shares of co

Apr 18, 2022

What issues should I consider regarding my Incentive Stock Options?

Incentive Stock Options (ISOs) are a form of equity compensation, offering employees a share in the potential appreciation of a company

Mar 31, 2022

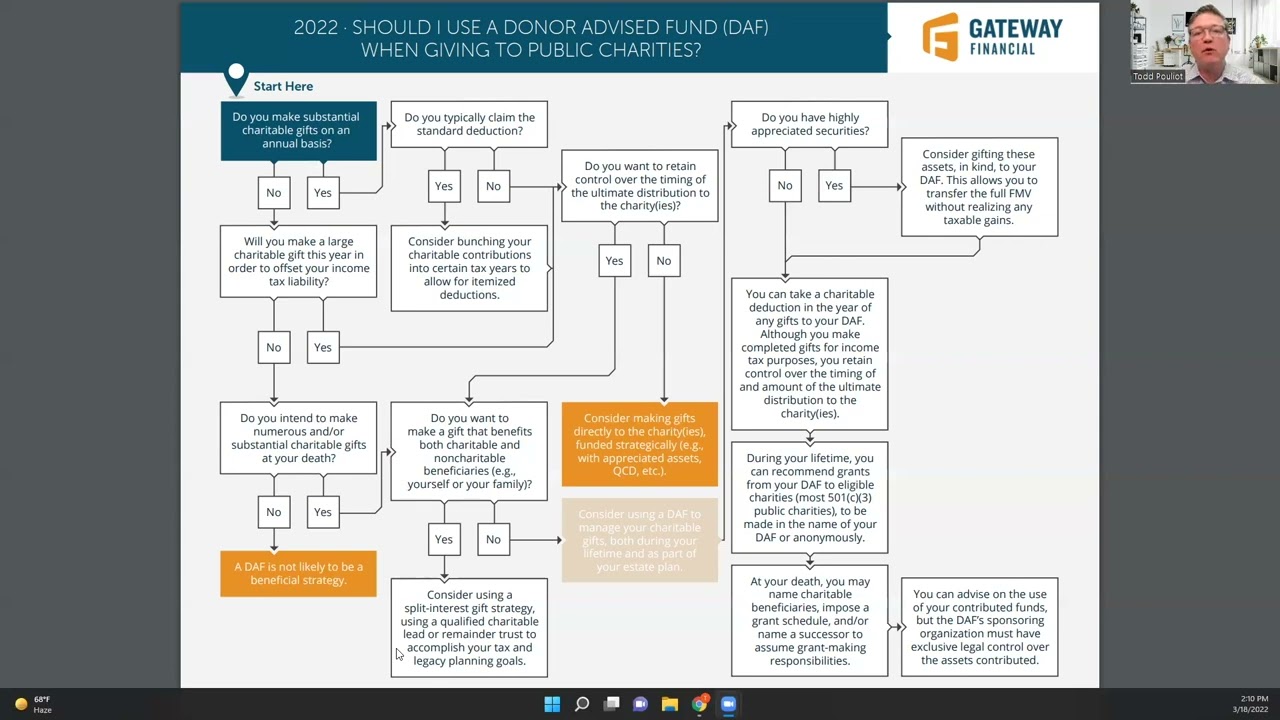

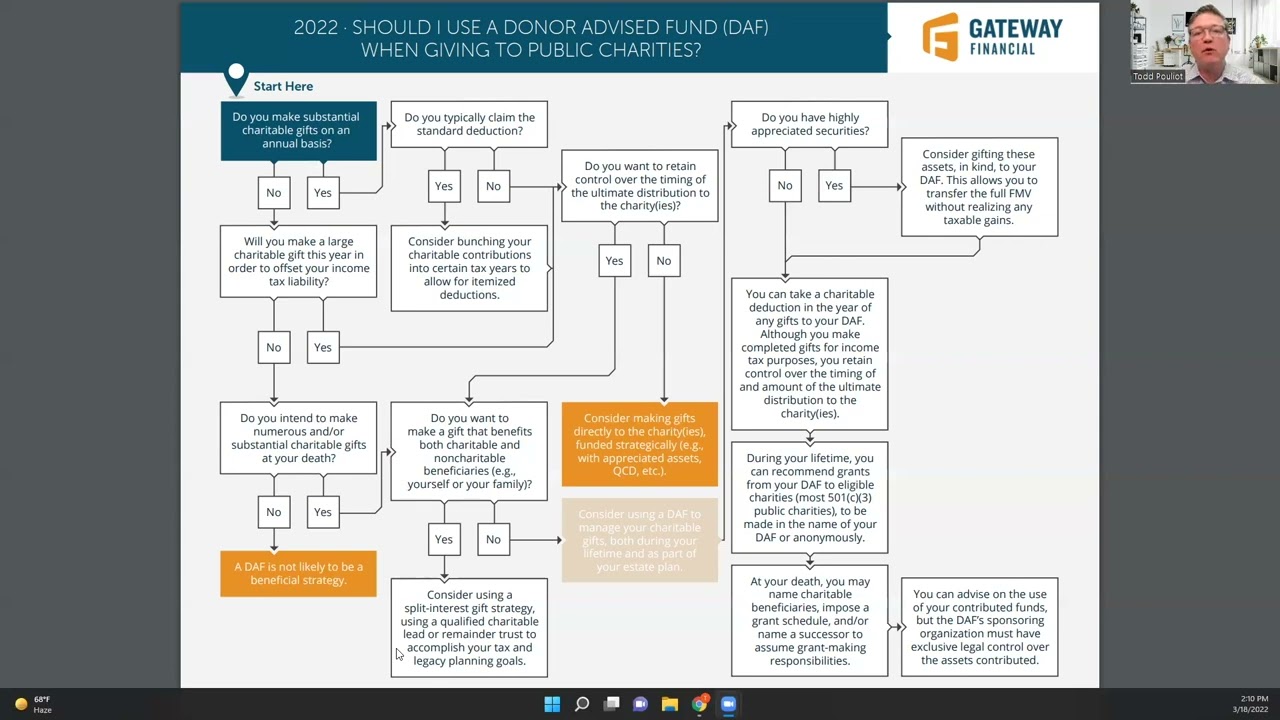

Should I Use A Donor Advised Fund DAF When Giving To Public Charities?

In the charitable giving realm, Donor Advised Funds (“DAFs”) have become increasingly popular and valuable planning vehicles.

Mar 24, 2022

As A Retiree, What Issues Should I Consider When Reviewing My Tax Return?

Reviewing a client’s tax return can always be an informative exercise to ensure we understand all sources of income and tax liabilities

Mar 23, 2022

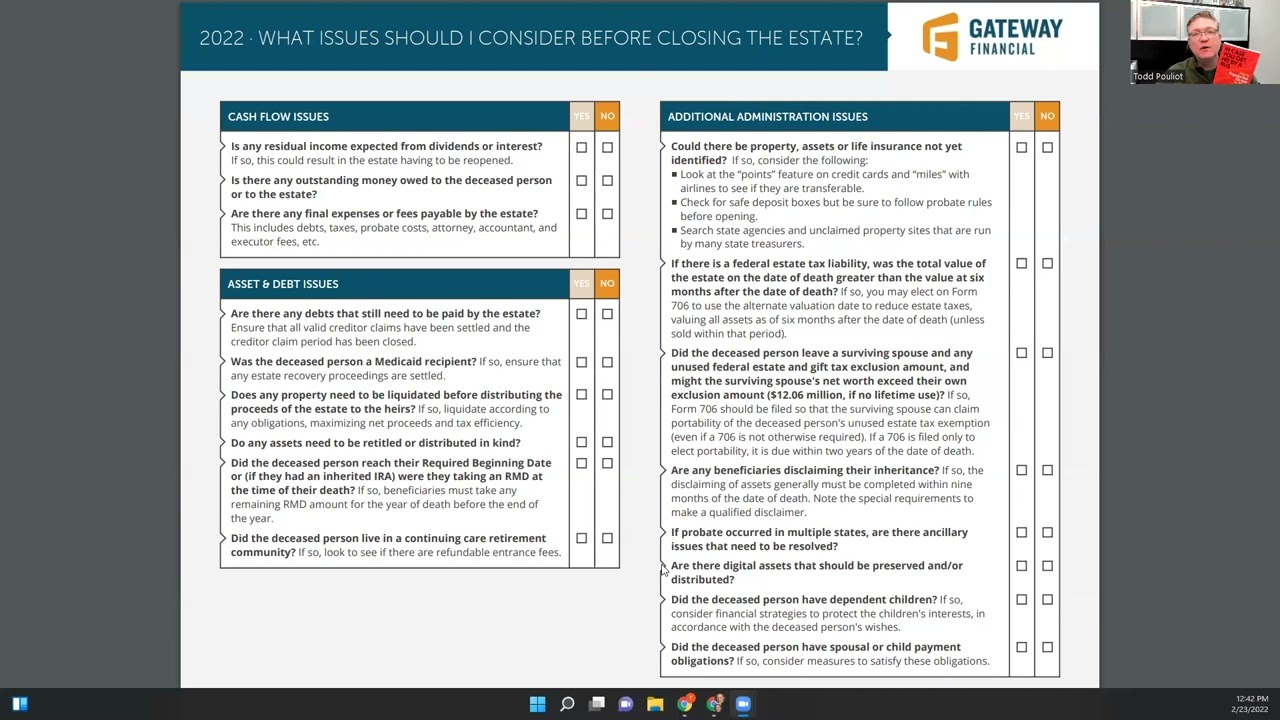

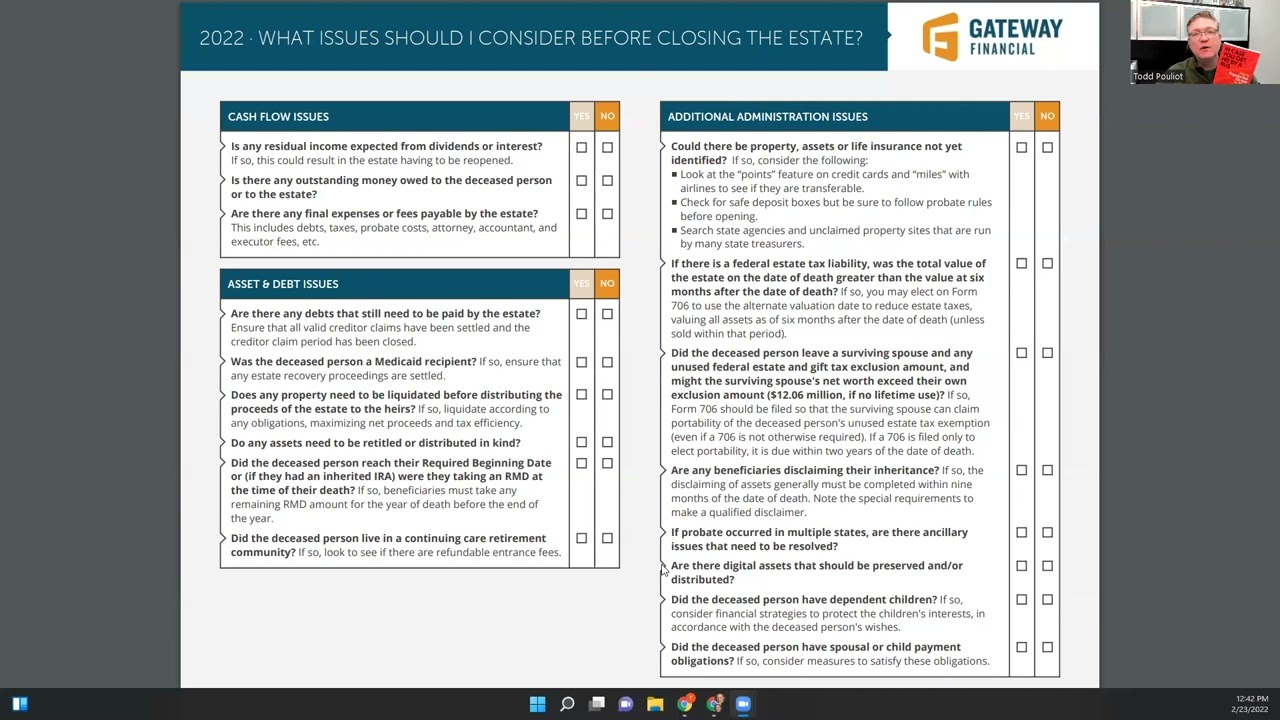

What Issues Should I Consider Before Closing The Estate?

This checklist covers 25 of the most important planning issues to identify and consider before a client closes an estate for a loved one.

Feb 25, 2022

Should I Roll Over My Dormant Traditional 401k

Common IRA and 401(k) features and differences Net Unrealized Appreciation options Age-based distribution options Taxes and penalties in...

Feb 22, 2022

What Will Have The Least Tax Impact Harvesting Capital Gains Or Roth Conversions?

Clients often have outsized positions due to appreciation and large pre-tax retirement accounts. They may be looking to reduce risk...

Feb 15, 2022

.png)